How to avoid scams when completing your tax return

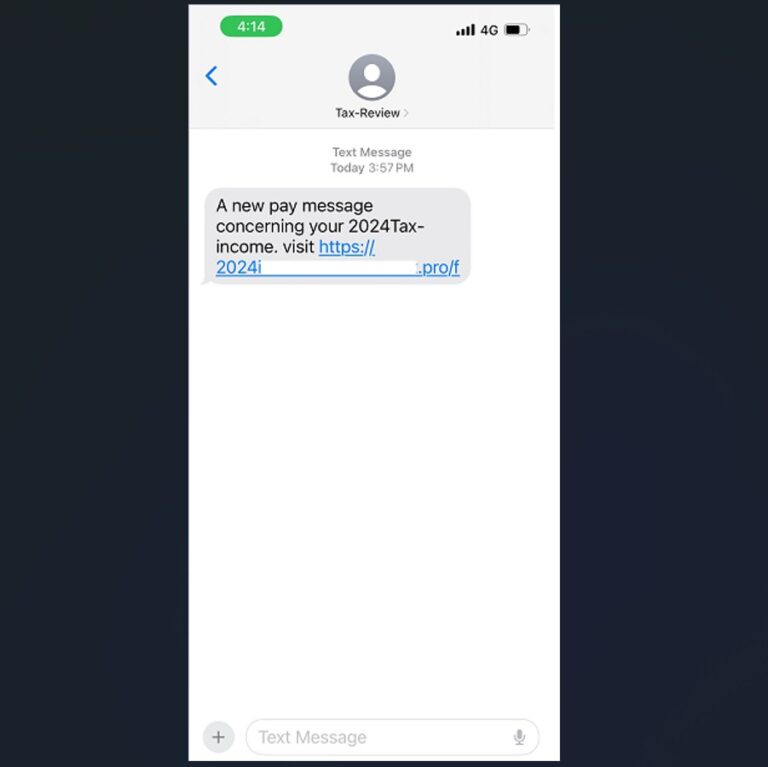

CPA Australia Australians should always be wary of online scams, but we are particularly vulnerable at tax time. Cyber criminals use a mix of tried-and-tested and new methods to attempt to defraud taxpayers, which is why CPA Australia is urging Aussies to be extra vigilant and take some simple measures to help protect themselves. Speaking on CPA Australia’s With Interest podcast this week, the ATO’s Assistant Commissioner of Cyber Governance, Joda Walter, said that ATO-branded SMS and emails containing links to fake myGov web pages remain one of the most common types of scams. Mr Walter also warned Aussies to be wary of fake social media accounts using the ATO and myGov brands. Most prominent on Facebook and X, these fake accounts interact with users and try to trick people into clicking links. How to spot tax time scams Distinguishing between legitimate and scam messages from the ATO is becoming increasingly difficult, however there are signs. “Scammers take advantage of any situation, and at tax time that means targeting unsuspecting individuals through unsolicited messages claiming to be the ATO or another reputable organisation – known as ‘phishing’ scams,” says CPA Australia spokesperson Gavan Ord. “These messages trick individuals into acting quickly and letting their guard down on the promise of financial gain or by convincing them they have done something wrong and need to rectify the situation quickly to avoid penalties. These scams prey on our natural instincts, which is why we need to stop and think before we click any links or give over any personal information.” “If in doubt, always stop, think, and don’t share any personal information, including your tax file number or bank details.” Young Aussies being caught out The ATO says that young Aussies aged 25-34 have been most likely to inadvertently share personal information to ATO impersonation scammers, but everyone is a target. “It can be hard for anyone to spot tax time scams and the fact that young, tech savvy Aussies are most likely to be the victim of ATO impersonation scammers should be a wake-up call to everyone,” said Mr Ord. “It’s definitely a good idea to check in with elderly and vulnerable family and friends to make sure they are aware of common scam types, but also remain vigilant yourself. It only takes a momentary lapse in judgement to be a victim.” Source: CPA Australia The information provided in this article is general in nature only and does not constitute personal financial advice.