Your super: A scammer’s new target

In a recent media release, the Australian Securities and Investments Commission (ASIC) warned about a new scam doing the rounds. Scammers attempt, through cold calls to superannuation savers, to extract…

In a recent media release, the Australian Securities and Investments Commission (ASIC) warned about a new scam doing the rounds. Scammers attempt, through cold calls to superannuation savers, to extract…

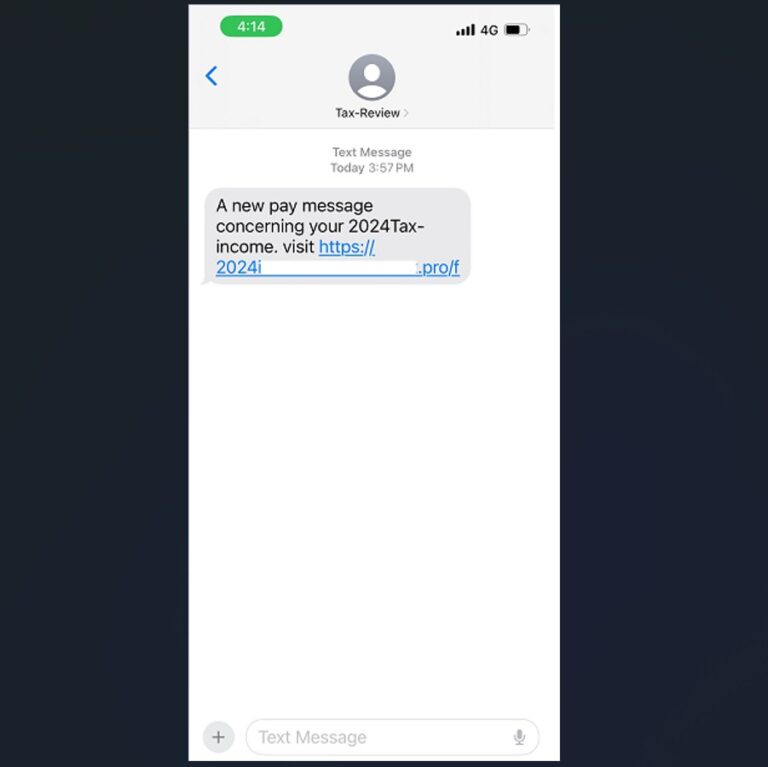

CPA Australia Australians should always be wary of online scams, but we are particularly vulnerable at tax time. Cyber criminals use a mix of tried-and-tested and new methods to attempt…

A year before retirement, Tess’s superannuation plan was on track, and she was imagining her post-work life. With savings of $34,000 at the bank, she was looking to park it…

End of content

End of content