Numbers vs. Emotions: The Real Game of Investing

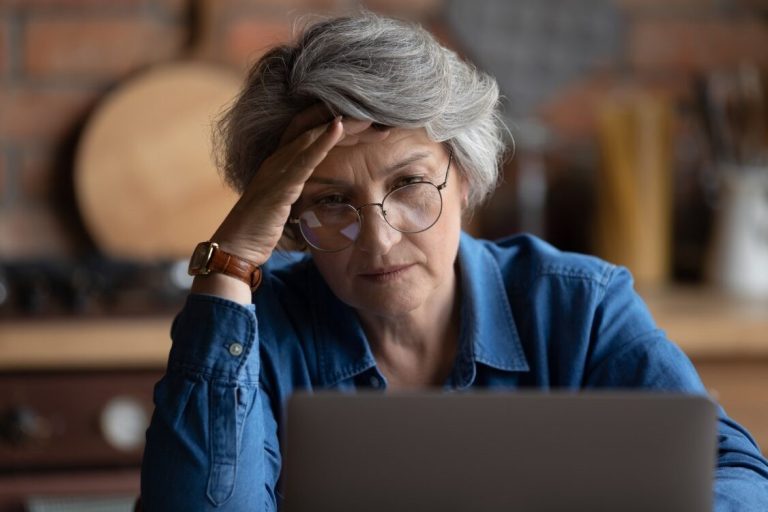

When people think about investing, they often focus on the numbers: analysing balance sheets, forecasting earnings growth, understanding sectors, and evaluating dividend yields and price-to-earnings ratios. While these elements are critical, they only make up 50% of the game. The other 50%? It’s something far less tangible but just as important—the psychological and emotional side of investing. The Role of Numbers in Investing Numbers, data, and analysis are the foundation of building a solid portfolio. They help answer key questions: This analytical side forms the basis of investment decisions—what to buy, what to avoid, and how to diversify. But understanding numbers is only half the challenge. The Harder Half: Investor Psychology The more difficult half of successful investing is managing emotions—what I often call “the feels.” Here’s why: markets are inherently emotional, driven by fear and greed. With today’s technology, investors can react to news—positive or negative—within seconds, causing markets to move sharply. This high liquidity makes it easy to fall into the trap of reacting emotionally rather than rationally. I’ve seen this firsthand with many clients, particularly retired men, who turn checking their portfolios into a daily hobby. The result? Anxiety and distress that often lead to poor decisions, such as selling in a downturn or chasing rising stocks out of fear of missing out. When Psychology Takes Over In times of market volatility—during corrections or crashes—the analytical side of investing takes a backseat. It’s no longer about the numbers; it becomes 100% psychological. These are the moments when: For those fully invested portfolios, the best decision may be to hold steady and ride out the storm. For others with cash reserves, it may be the perfect time to invest, capitalizing on undervalued opportunities. Making the Right Decisions at the Worst Times As a financial adviser, my role during these challenging times is to help clients make rational decisions, even when emotions are running high. Sometimes, that means encouraging them to step away: Because when emotions dictate actions, mistakes are often made. But when fear is at its peak, it’s also the time when opportunities are greatest. As I often say: “When my clients feel this crummy, it’s probably time for me to get excited and buy.” Competent investing requires a balance of analysis and psychology. While the numbers matter, it’s the ability to manage emotions during the tough times that separates successful investors from the rest. The information provided in this article is general in nature only and does not constitute personal financial advice.