How to avoid scams when completing your tax return

CPA Australia

- Scams are becoming more sophisticated but there are signs to spot them

- Always stop and think carefully – don’t hand out any personal information

- Young Aussies most likely to fall victim to ATO impersonation scammers

Australians should always be wary of online scams, but we are particularly vulnerable at tax time.

Cyber criminals use a mix of tried-and-tested and new methods to attempt to defraud taxpayers, which is why CPA Australia is urging Aussies to be extra vigilant and take some simple measures to help protect themselves.

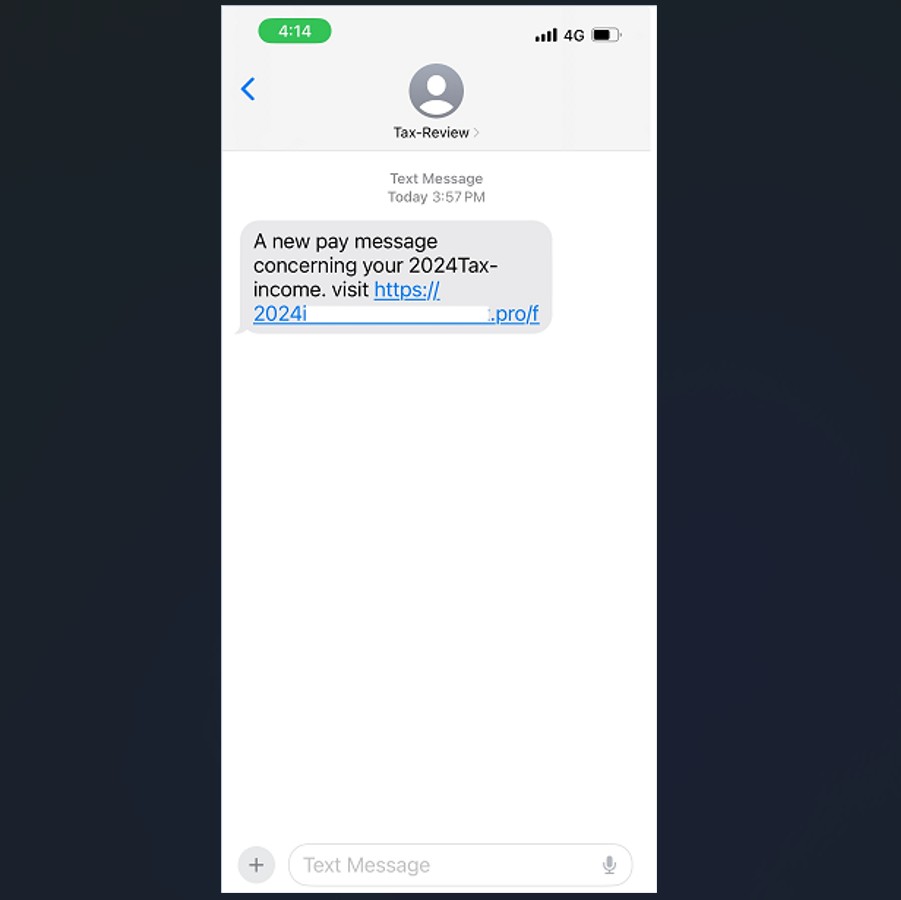

Speaking on CPA Australia’s With Interest podcast this week, the ATO’s Assistant Commissioner of Cyber Governance, Joda Walter, said that ATO-branded SMS and emails containing links to fake myGov web pages remain one of the most common types of scams.

Mr Walter also warned Aussies to be wary of fake social media accounts using the ATO and myGov brands. Most prominent on Facebook and X, these fake accounts interact with users and try to trick people into clicking links.

How to spot tax time scams

Distinguishing between legitimate and scam messages from the ATO is becoming increasingly difficult, however there are signs.

- Look for any grammatical errors or unusual language in emails or SMS messages.

- The ATO has removed hyperlinks in unsolicited SMS messages to make it easier for people to spot real messages from the fake ones. If you see any links in an SMS or QR codes in a message claiming to be from the ATO, this will be a scam.

- When it comes to emails, check the sender’s address. Anything unusual is a red flag. If the address includes the acronym ATO or Australian Taxation Office in full, look for subtle anomalies like using a number, adding extra letters, or even removing a letter.

- Be wary of anyone making unexpected requests for personal or financial information, especially if they claim it’s urgent. The ATO will never ask for passwords, account numbers or other sensitive data by email or SMS.

- If you see a social media account claiming to be the ATO or myGov, look for the official logo and profile verification, such as the blue tick on Facebook and Instagram or grey tick on X.

- The ATO will never discuss your personal ATO account on any social media platform, including private messages. If this ever happens, block and report the account by taking a screenshot and sending it to reportscams@ato.gov.au

- If you’re still unsure, you should always verify if the contact is legitimate by contacting the ATO on 1800 008 540 or by visiting the verify or report scam page on the official ATO website.

“Scammers take advantage of any situation, and at tax time that means targeting unsuspecting individuals through unsolicited messages claiming to be the ATO or another reputable organisation – known as ‘phishing’ scams,” says CPA Australia spokesperson Gavan Ord.

“These messages trick individuals into acting quickly and letting their guard down on the promise of financial gain or by convincing them they have done something wrong and need to rectify the situation quickly to avoid penalties. These scams prey on our natural instincts, which is why we need to stop and think before we click any links or give over any personal information.”

“If in doubt, always stop, think, and don’t share any personal information, including your tax file number or bank details.”

Young Aussies being caught out

The ATO says that young Aussies aged 25-34 have been most likely to inadvertently share personal information to ATO impersonation scammers, but everyone is a target.

“It can be hard for anyone to spot tax time scams and the fact that young, tech savvy Aussies are most likely to be the victim of ATO impersonation scammers should be a wake-up call to everyone,” said Mr Ord.

“It’s definitely a good idea to check in with elderly and vulnerable family and friends to make sure they are aware of common scam types, but also remain vigilant yourself. It only takes a momentary lapse in judgement to be a victim.”

The information provided in this article is general in nature only and does not constitute personal financial advice.