Super contributions explained . . . easily

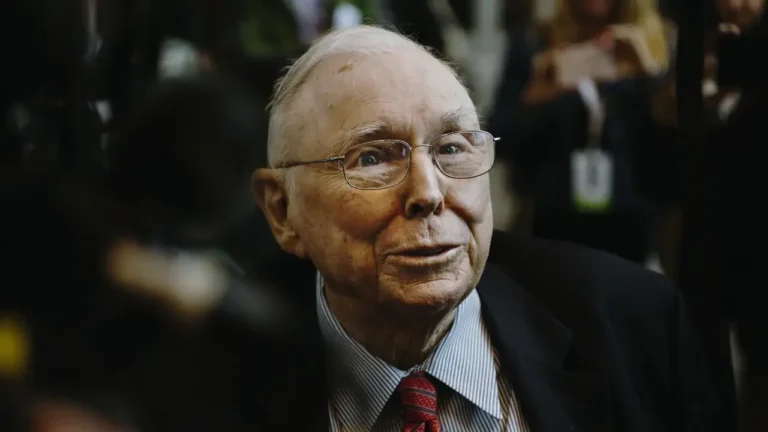

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”

This simple reflection struck a chord with me. It got me thinking about the delicate balance between saving for the future and living fully in the present. While we all know the importance of financial security, is it possible to save too much—at the expense of the moments that matter most?